Why More Players Now Prefer Online Casinos Over Las Vegas

For decades, Las Vegas stood as the ultimate gambling destination. Its neon-lit Strip became a global symbol of chance and luxury, drawing millions of visitors annually who dreamed of striking it rich. From blackjack at the Bellagio to poker at the Mirage, the city offered both prestige and entertainment on an unmatched scale.

But in 2025, the balance of power is shifting. Our latest analysis shows that one in three players now prefer online casinos over Las Vegas-style venues.

What began during the COVID-19 pandemic as a temporary solution has matured into a long-term trend. Today’s players value instant access, lower costs, and immersive live casino experiences that rival land-based play. With 5G connectivity, smartphone innovation, and AI-driven personalization, online platforms have become the default for millions of gamblers worldwide.

According to Statista, the global online gambling market is expected to grow by more than 9% annually through 2027, reaching $130 billion in revenues. By comparison, the Las Vegas Strip has seen slower growth of just 3–4% per year in gaming revenue. This widening gap underscores the growing dominance of digital platforms in the gambling industry.

This article explores the evolution of the gambling industry, the technological and demographic drivers, the industry’s adaptations, and the future outlook. It shows why online casinos are no longer an alternative but a new global standard for gambling.

From Vegas Dominance to Digital Preference

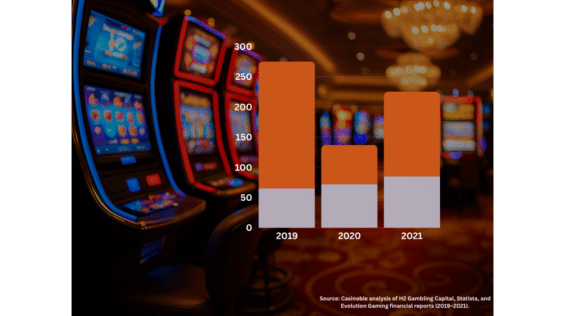

This chart shows the impact of the COVID-19 pandemic on gambling revenues in 2020. Land-based casinos, including Las Vegas and Macau, saw revenues fall by more than 70%, while online casino operators posted record highs, with some suppliers like Evolution Gaming reporting double-digit revenue growth. The data illustrates how the pandemic acted as a tipping point for the shift toward online gambling.

The Golden Era of Las Vegas

Las Vegas was unmatched for decades. In 2019, the city welcomed more than 40 million visitors, generating $6.59 billion in gaming revenue on the Strip alone (Las Vegas Convention & Visitors Authority). Beyond gambling, hotels, concerts, and conventions turned Vegas into a multi-billion-dollar entertainment hub.

The aura of playing on the Strip carried prestige. It wasn’t just about the games but about being part of a cultural spectacle.

The Early Years of Online Gambling

The late 1990s saw the emergence of the first online casinos. While they offered convenience, they struggled with credibility. Early sites ran on slow dial-up internet, used clunky graphics, and lacked transparency, creating mistrust among players.

Throughout the 2000s, improvements in broadband and software technology made online casinos increasingly appealing, particularly in Europe. Still, Vegas retained its dominance as the epicenter of global gambling.

Early pioneers such as Microgaming and Playtech launched the first real-money online casinos in the late 1990s. These platforms offered simple slots and blackjack tables, but early dial-up connections, primitive payment processing, and the absence of regulatory oversight significantly limited their capabilities. Withdrawals could take weeks, credit card transactions were frequently blocked, and disputes often went unresolved — factors that discouraged many potential players.

During the same period, alternative hubs such as Atlantic City and Macau experienced steady growth. Yet, Las Vegas remained unrivaled because its land-based model still promised prestige and trust that digital platforms lacked. The aura of playing under the Vegas lights outweighed the convenience of logging in from a desktop PC.

Pandemic as Catalyst

The COVID-19 pandemic was the turning point. When land-based casinos closed, online gambling became the only option. Players discovered variety, accessibility, and innovative formats, such as live dealer games.

Even after restrictions were lifted, the convenience of online gambling proved too compelling. For many, what began as a necessity became a preference.

Macau, once hailed as the “Las Vegas of the East,” saw revenues plunge by more than 70% in 2020, while online casino operators posted record highs. Evolution Gaming, the leading live dealer supplier, reported double-digit revenue growth throughout 2020 and 2021 as global players embraced streamed tables. These results revealed that online gambling was no longer a backup option but a resilient, scalable model. By 2022, investment in mobile-first platforms and live dealer studios surged, laying the foundation for the sustained shift we now see in 2025.

Why Players Didn’t Return Exclusively to Vegas

Cost is a decisive factor. Online casinos eliminate the extra expenses of flights, hotels, and dining, making them more affordable than a weekend on the Strip. Convenience adds to the appeal. Players can log in instantly from home or on the go, instead of planning an entire trip around a gambling session.

Variety also plays a major role. Digital platforms host thousands of slot titles, crash games, and live dealer tables — far more than the limited space of a physical casino. Social interaction, once seen as exclusive to Vegas, is now delivered online. Live dealer streams and in-game chat recreate the communal buzz that keeps players engaged.

In 2025, these combined advantages established online casinos as the preferred choice for one-third of players worldwide, reshaping the future of the industry.

Technology and Market Analysis

5G Networks Powering Real-Time Play

5G networks have transformed online gambling. With speeds 100 times faster than 4G, 5G delivers ultra-low latency and seamless high-definition streaming. According to Ericsson, over 4 billion 5G subscriptions will exist by the end of 2025, covering 60% of the global population.

Operators using 5G report session lengths increasing by more than 35%, indicating that smoother connectivity keeps players engaged for longer periods.

Smartphones: Portable Casinos

Smartphones have become the backbone of online gambling. Statista reports that 85% of devices shipped in 2024 supported HDR video and advanced rendering, delivering console-quality graphics. Multi-core processors, GPUs, and batteries lasting over 10 hours make extended mobile sessions possible.

For younger generations, smartphones are the primary gambling device — intuitive, mobile, and always on hand.

Software Innovations

Hardware is only half the story. Casino software has evolved with mobile-first optimization. Progressive Web Apps (PWAs) let players enjoy app-like performance without downloads. Adaptive streaming ensures video quality remains consistent even under fluctuating network connections. Gamification, including achievements and loyalty tiers, helps maintain high engagement.

Gamification borrows heavily from mainstream mobile games. Daily login rewards, seasonal challenges, and unlockable achievements encourage repeat play while fostering a sense of progression. These features turn gambling into an ongoing entertainment journey rather than a one-off session.

Payments: Trust and Localization

Payments have undergone a revolution in recent years, eliminating one of the biggest barriers to online gambling adoption. More than 40% of players now prefer e-wallets such as PayPal, Skrill, or Neteller for their speed and reliability. Around 15% opt for cryptocurrency, particularly Bitcoin and Ethereum, attracted by instant settlement and lower fees. In fast-growing regions, localized systems dominate: Brazil’s PIX enables frictionless real-time transfers, while India’s UPI integration has unlocked mass adoption. Together, these innovations build trust, remove friction, and make online play more attractive than the physical act of cashing chips on the Vegas floor.

Market Growth and Revenues

- Global online gambling revenues are projected to surpass $130 billion by 2027, growing at over 9% CAGR.

- Land-based casinos expand at just 3–4% annually.

- By 2030, online platforms could account for 40% of global revenues.

Data shows online-first players:

- Spend 20–25% longer per session than land-based counterparts.

- Generate higher average revenue per user (ARPU) due to cross-sell opportunities.

- Show 12% lower churn rates when targeted with personalized promotions.

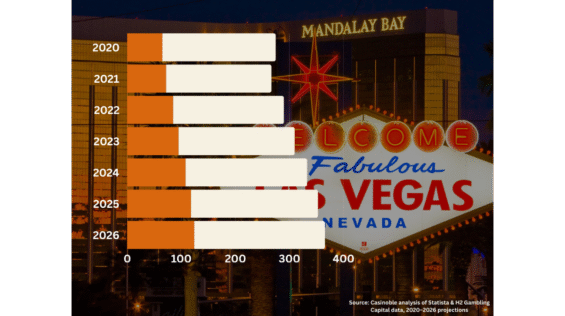

This chart compares the global revenue growth of online casinos versus land-based casinos between 2020 and 2026. Online revenues are projected to nearly double from $65 billion to $124 billion, growing at more than 9% CAGR. Land-based casinos recover more slowly, rising from $210 billion to $242 billion at just a 3–4% CAGR.

Demographics and Player Insights

Millennials and Gen Z at the Forefront

Millennials and Gen Z are driving the online boom. Research from GlobalWebIndex shows 72% of players aged 18–34 prefer mobile gambling. Their motivations include:

- Instant access to entertainment.

- Social features like live dealer chat.

- Personalized offers tailored by AI.

For them, gambling is not a destination trip but an integrated part of digital life.

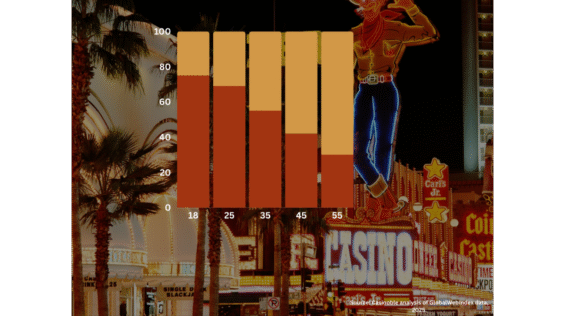

This chart illustrates gambling preferences by age group in 2025. Younger players (18–34) overwhelmingly prefer online casinos, with nearly three-quarters choosing mobile and digital play. Older demographics remain more loyal to land-based casinos, highlighting how generational shifts are reshaping the market.

Regional Markets

In Southeast Asia, smartphone penetration above 70% has fueled rapid growth, with Indonesia and Vietnam emerging as key markets. Latin America is also expanding quickly, led by Brazil’s adoption of PIX payments and regulatory reforms, pushing regional CAGR above 12%. North America continues to evolve through a state-by-state rollout in the U.S., while Canada has embraced a national framework that provides greater consistency. Europe remains a mature but increasingly mobile-driven market, with strong oversight in the UK and Nordic countries ensuring both growth and compliance.

Gender and Behavioral Shifts

Female participation is rising, particularly in slots, bingo, and mobile-friendly games. Behavioral studies show online-first players favor shorter, more frequent sessions, contrasting with all-day visits to land-based venues.

Psychographic studies show that online-first players are motivated less by the pursuit of “big wins” and more by convenience, flexibility, and entertainment value. Many treat gambling as a casual pastime similar to streaming or mobile gaming, fitting short sessions into breaks at work or commutes.

Female participation has also increased significantly. We estimate that women now account for nearly 35% of online gamblers, up from less than 20% a decade ago. Mobile-friendly interfaces, transparent payments, and games like bingo, keno, and themed video slots have proven especially popular. The result is a more diverse player base, one that differs markedly from the traditionally male-dominated audiences in land-based casinos.

Industry Response and Adaptation

Online Operators Innovating

Operators have embraced mobile-first strategies:

- Apps with biometric login, instant withdrawals, and push notifications.

- Mobile-only promotions to boost retention.

- AI personalization for tailored experiences.

- Cross-device integration for seamless play across devices.

They are also implementing responsible gaming tools, including spend limits, AI-driven monitoring, and self-exclusion options.

Las Vegas Reacts

Las Vegas casinos are adapting through:

- Hybrid experiences, like streaming live dealer tables online.

- Partnerships with digital operators to expand reach.

- Diversifying attractions beyond gambling, with concerts, shows, and luxury dining as major draws.

Case studies illustrate how major brands are adapting. MGM Resorts has expanded its BetMGM product into multiple U.S. states, combining its physical presence with a robust digital footprint. Caesars Entertainment has integrated its loyalty program across online and offline properties, allowing players to earn and redeem rewards seamlessly. Meanwhile, suppliers like Evolution Gaming have expanded their live dealer studios worldwide, operating mobile-optimized streaming hubs in Europe, North America, and Asia. These strategies demonstrate how the lines between land-based prestige and digital convenience are blurring, shaping a hybrid gambling ecosystem.

Marketing Shifts

Advertising now targets mobile-first channels. Social media campaigns, influencer partnerships, and app-based promotions dominate. Affiliates increasingly focus on retention and mobile SEO, not just acquisition.

Future Outlook and Challenges

Opportunities

Opportunities for online operators are expanding rapidly. Augmented and virtual reality are moving from experimental features to mainstream investments, promising fully immersive casino environments that replicate or even surpass land-based play. Blockchain-based payment systems are also gaining traction, offering faster, cheaper, and more secure transactions that appeal to both players and regulators. Artificial intelligence continues to evolve, enabling hyper-personalized offers, predictive player modeling, and stronger fraud detection. At the same time, emerging markets in Latin America and Asia are opening under new regulatory frameworks, creating fertile ground for expansion. Together, these trends position online casinos for unprecedented global growth.

The Future of Las Vegas

Vegas will remain iconic, but its dominance is waning. Its future lies in hybrid entertainment, combining physical spectacle with digital integration. Gambling alone can no longer define the city.

Challenges

The challenges are equally significant. Regulatory fragmentation remains one of the industry’s most pressing issues. In the UK, stricter affordability checks and advertising rules increase compliance costs, while in the U.S., operators must navigate a complex state-by-state system. Canada has taken a more unified approach, but in Asia, the picture is mixed: China bans most forms of online gambling. At the same time, the Philippines positions itself as a regional licensing hub. Responsible gambling is another concern. Greater accessibility means operators must implement robust safeguards, from AI-driven monitoring to mandatory spend limits, to protect vulnerable players. Ultimately, the industry is facing intensifying competition. With new platforms launching constantly, innovation is no longer optional — it is essential for survival.

Conclusion

The revelation that one in three players now prefer online casinos over Las Vegas signals a permanent realignment in global gambling. Once seen as a complement to land-based casinos, online platforms have become the first choice for millions worldwide.

For operators, the path forward is clear: invest in mobile-first design, AI-driven personalization, and localized expansion to capture this growing digital audience. For Las Vegas, the challenge is reinvention — evolving from the world’s gambling capital into a hybrid entertainment hub where physical prestige and digital innovation coexist.

The casino floor is no longer confined to the Strip. It now exists in every pocket, on every device, and in every market where players connect. By 2035, analysts predict online revenues could even overtake land-based gambling entirely, underscoring a future where digital casinos are not just an alternative, but the foundation of the industry.

FAQs

Online casinos deliver convenience, variety, and cost savings. Players can gamble instantly from home or on the go, avoiding the expenses of Vegas trips. With 5G streaming and console-level smartphones, the digital experience rivals land-based casinos.

Yes. Millennials and Gen Z lead the shift, with 72% of 18–to 34-year-olds preferring mobile gaming. Their digital lifestyles make online platforms the natural choice over destination trips.

Not entirely. Vegas remains an entertainment icon, but is no longer unrivaled. Its strategy now includes hybrid digital offerings and diversification beyond gambling to maintain global appeal.

Global online revenues are forecast to surpass $130 billion by 2027, growing more than twice as fast as land-based casinos. By 2030, online platforms could represent 40% of global revenues.

Key drivers include 5G networks, smartphone hardware, AI-driven personalization, blockchain payments, and AR/VR experiences. These make online casinos more immersive, secure, and accessible than ever before.

Operators utilize tools such as deposit limits, self-exclusion programs, and AI monitoring to identify and prevent risky behavior. Regulators in markets such as the UK and Europe require transparent safeguards, prompting operators to strike a balance between innovation and responsibility.

Trust has improved significantly thanks to stricter regulation and independent audits. Testing agencies such as eCOGRA certify RNGs to ensure fairness, while the visibility of live dealers on HD streams boosts transparency. Combined with responsible gaming tools, these measures help reassure players that online platforms are both safe and fair, narrowing the gap between perception and reality.

Most Recent News

Get the latest information